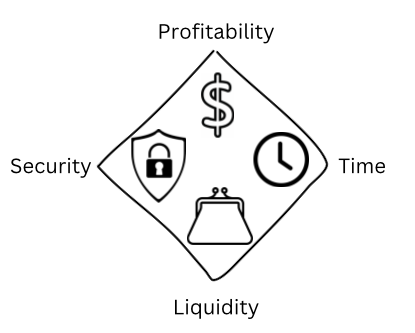

The Magic Square of Investment

What basic expectations do you have of an investment and an investment vehicle? Before pursuing an investment strategy, everyone should be aware of the following points:

How willing am I to accept fluctuations in value? Am I in a position to bear any financial losses?

How long can I do without the capital to be invested? When must the money be available to me again?

- What are my investment objectives? How high is my return expectation?

These questions reflect the 5 basic investment criteria: security, liquidity, profitability, and time. Of course when choosing YOUR perfect investment strategy, you should always be open to learn, discover multiple paths and have diverse sources of information. There is not only one strategy that works. Don’t force yourself in mastering a strategy that is not fitting with your interests and your lifestyle. You should personally evaluate each strategy based on this square:

1) Profitability: Before starting an investment, you should be aware of wether your investment is actually profitable and who earns money after you purchased the asset.

For example: Have you ever heard of someone becoming rich by giving money to a bank and leaving it on the savings account?

2) Security: Security is the preservation of your assets. What risks are your investments exposed to?

Examples are: Issuer risk (Lehman or Silicon Valley Bank), Black Swan events (COVID), Political risks (e.g. expropriation), or short squeeze (Gamestop)

3) Liquidity: Here you need to consider the liquidity of yourself and the potential buyer or customer when selling the asset. Are you ok with keeping the money in your assets for longer time? This should always be your key consideration. Another aspect of liquidity is, wether there is a market for you selling the asset.

For example: gold is a highly liquid market. We recently came across the trend of buying small amounts of rare physical metals. If doing so, please check beforehand where you can sell it. Same with options trading, you need to be aware of the options volume beforehand.

4) Time: This is in our view the most important aspect. Money comes and goes. Time only goes. How long does it take you to understand the investment class, in which frequencies do you need to monitor your investment and does this line-up with your lifestyle?

Examples are: A day trader and a real-estate investor typically dedicate different time frames to their investments.

There are other considerations before you start an investment. Among them, knowledge and mindset are also key considerations. We will cover both in other articles.

Please reach out to us via social media if you have questions on the Magic Square of Investments!