Sectors and Industries

The global stock market operates as the cornerstone of modern financial economies. Comprising multiple sectors and industries, it reflects the intricate web of trade and commerce that fuels worldwide economic growth. Within this arena, investors and analysts observe the ebb and flow of capital as a barometer of both fiscal health and technological progress. The financial market is segregated into several key sectors, each representing a significant area of the economy.

Below is a pie chart showing all sectors and industries across the world. Our infomagician made it interactive: Click on the sector for higher resolution and click the center again to move back!

Among these, Technology stands out as a powerful force, driving innovation and offering the promise of continued growth in a rapidly evolving landscape. The Tech sector, including titans of industry and agile start-ups alike, is not just transforming the way we live and work but also reshaping the value propositions within the stock market itself.

The Healthcare sector has displayed resilience and growth potential. Investors look to this sector not just for stability but also for the breakthroughs in medical technology and pharmaceuticals that signify hope and advancement.

Another central player is the Financial sector, including banking, investment services, and insurance. The health of this sector is often regarded as a direct reflection of the overall economy’s vitality, with its performance being a crucial indicator for market analysts.

The Industrials sector comprises a diverse range of companies, from aerospace and defense to logistics and construction. This sector serves as a barometer for industrial activity and economic resilience. Companies within this space are integral to infrastructure development and are often at the forefront of innovation in areas such as automation and manufacturing efficiency. Their performance can be indicative of broader economic health, as increased industrial activity often correlates with a burgeoning economy.

The Consumer Cyclical (or Discretionary) sector, encompassing goods and services that are non-essential but desirable, is especially sensitive to macroeconomic cycles. As such, it serves as a lens through which investors can gauge consumer confidence and spending power.

The Energy sector is undergoing a transformative shift. As the world increasingly seeks sustainable and renewable energy sources, traditional fossil fuel giants are adapting, and a new breed of companies is emerging, challenging the status quo and presenting fresh investment landscapes.

The Basic Materials sector forms the foundation of the industrial and construction segments. This sector includes companies involved in the discovery, development, and processing of raw materials—ranging from metals and minerals to chemicals and forestry products. Together with the Industrials, Consumer Cyclical, and Energy sectors the Basic Materials embody the tangible backbone of the market, reflecting an economy’s strength and its potential for sustained growth.

The Consumer Defensive sector, also known as Consumer Staples, provides goods and services considered essential to consumers. This sector is characterized by stable demand, regardless of economic fluctuations, including products like food, beverages, household, and personal products. Due to the non-cyclical nature of its demand, the Consumer Defensive sector often serves as a safe haven for investors during economic downturns, providing steady dividends and resilience against market volatility.

Utilities encompass companies that provide essential services such as water, electricity, and natural gas. Characterized by regulated markets and predictable revenue streams, this sector is known for its defensive investment profile. Utilities are often prized by income-focused investors for their typically reliable dividends, which can provide a buffer during uncertain market conditions and economic instability.

Real Estate represents a pivotal market sector, including residential, commercial, and industrial properties, as well as real estate management and development companies. Given its sensitivity to interest rates, economic policies, and demographic trends, the sector is a critical gauge of economic health. With the advent of real estate investment trusts (REITs), investors have a vehicle for adding real estate exposure to their portfolios, offering potential diversification benefits and passive income through dividends.

Communication Services is a broad sector that spans legacy telecommunications, media, and internet service providers alongside newer technology platforms that facilitate digital communication and content. As society becomes increasingly reliant on connectivity and entertainment, companies in this sector occupy a crucial role in both the economy and the daily lives of consumers. The sector’s growth is fueled by rapid technological advancements and ongoing innovations in how people interact and consume media.

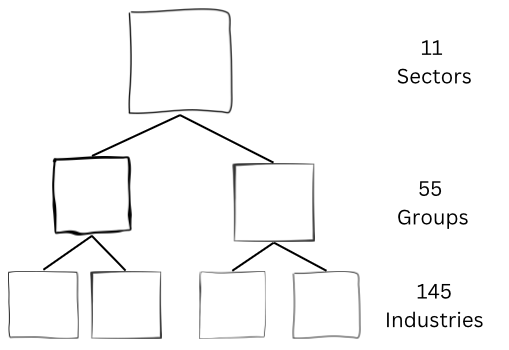

Each sector is further divided into industries, specialized groups that allow for more granular analysis and investment strategies. As an example, within the Technology sector, the semiconductor industry stands as a critical component, given its role in powering everything from consumer electronics to sophisticated AI systems.

In this intricate tapestry of sectors and industries, forward-looking statements suggest a future where AI technology not only enhances productivity but also offers transformative investment opportunities. With the rise of Big Data and machine learning, companies that leverage these technologies are poised to offer unprecedented value propositions. As such, sharp-eyed investors are monitoring these developments closely, recognizing the potential for significant returns.

We do tell our clients, that the stock market’s landscape is ever-evolving, with technological innovations consistently creating new investment frontiers. Understanding the interplay between different sectors and industries is paramount for investors aiming to capitalize on these shifts.

In conclusion, the global stock market is a reflection of human innovation and enterprise. It is within these sectors that the future of global economic prosperity is being charted, with every tick of the stock market offering a narrative of human progress.